are st jude raffle tickets tax deductible

Senior CitizenDisabled PersonsSurviving Spouse - An annual 250 deduction from property taxes is provided for the dwelling of a qualified senior citizen disabled person or their surviving spouse. If you receive a benefit from making a donation you can.

House Raffle Saint Joseph Health System

Now direct donations to the School of St Jude will be tax deductible.

. Jude Dream Home tickets arent tax-deductible. Although raffles tickets are a form of donation they are not tax deductible. Want to Make a Difference in the Lives of Kids with Cancer.

The gift must be made to a deductible gift recipient. The IRS does not consider raffle tickets to be a tax-deductible contribution. A gift is a voluntary transfer of money or property where you receive nothing in return.

The gift must be money or property which includes financial assets such as shares. Each winner must accept the prize. The gift must truly be a gift.

Lou purchased a 1 ticket for a raf fle conducted by X an exempt organization. However raffle tickets are not tax deductible regardless of whether the community or charitable organisation has Deductible Gift Recipient status. To qualify you must be age 65 or older or a permanently and totally disabled individual.

When you get a ticket youre signing up for a chance to win in a raffle. Organization Type Location Revenue. Raffle Tickets and Prizes St.

The cost of a raffle ticket is not deductible as a charitable contribution even if the ticket is sold by a nonprofit organization. Fails to withhold correctly it is liable for the tax. Because the proceeds from the wager are greater than 5000 6000 prize minus 1.

August 30 2021 1751. Yerba Buena Center for the Arts interpretation and application of the rules and regulations shall be final. Organizations like St Jude S House of Prayer.

Ad Make Your Quinceañera More Meaningful by Starting a Fundraiser for St. For specific guidance see this article. The IRS considers a raffle ticket to be a contribution from which you benefit.

This is because the purchase of raffle tickets is not a donation ie. Most recent tax filings. There is the chance of winning a prize.

Mail return receipt requested to the email andor mailing address provided by the ticket purchaser. Want to Make a Difference in the Lives of Kids with Cancer. We will also notify each winner in writing by sending a Winner Notification Agreement WNA by secure electronic communication or certified US.

NJ which was founded in 1977 and has an unknown amount of revenue and number of employees. On October 31 2004 the drawing was held and Lou won 6000. Greenville Avenue Allen TX 75002 - 972 727-1177 Phone 972-727-1401 Fax Login.

Jude Catholic Church - 1515 N. When you get a ticket youre signing up for a chance to win in a raffle. Ad Make Your Quinceañera More Meaningful by Starting a Fundraiser for St.

Pay Off Our Debt Fundraiser St Laurence Catholic Church Elgin Il

St Jude Dream Home Tickets Sold Out

Fundraiser By Evlos Technology Evlos Technology Holiday Charity Raffle

St Jude The Apostle Catholic Church

Play House For St Luke S Children S Hospital 2012

2022 Dream Home Giveaway Sacramento Ca St Jude Children S Research Hospital

House Raffle Saint Joseph Health System

Frequently Asked Questions Faq Home For The Holidays

Tickets Now On Sale For 2022 St Jude Dream Home Giveaway Fox 2

Team Yolo St Jude Heroes Home Facebook Oak Grove La

Are Raffle Tickets Tax Deductible The Finances Hub

Fun Fact Charity Raffle Tickets Are Not Tax Deductible

Dundee Ky Giving Away A 1950 Ford Custom Convertible

2022 St Jude Dream Home In Sylvania Ohio Wtol Com

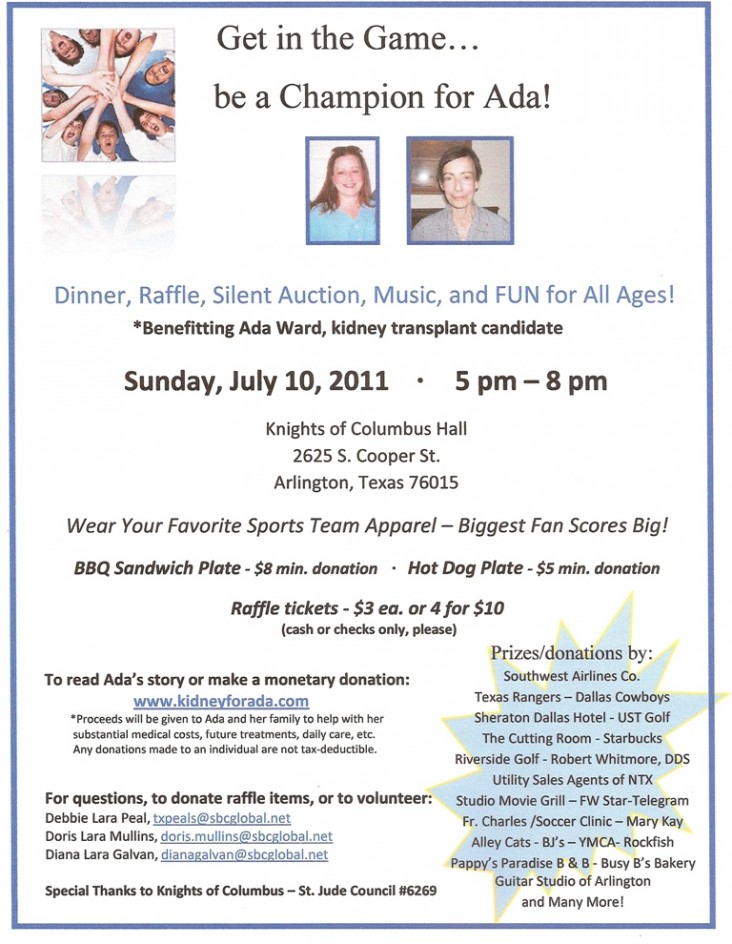

7 July 2011 Fundraiser Pictures Kidneyforada

Give The Gift Of Education Help St Jude Families Stjudeschool